Opening Opportunities: A Comprehensive Overview to E2 Visa Financial Investment

The E2 Visa offers a distinct chance for international capitalists looking for to develop a grip in the united state market. Comprehending the complexities of qualification requirements, investment kinds, and the necessary parts of a compelling service plan is important for a successful application. However, potential risks and difficulties can develop during the process, making it vital to approach this trip with enlightened methods. As we explore the important components of E2 Visa financial investment, one must consider what absolutely establishes apart successful applications from the rest.

Comprehending the E2 Visa

The E2 Visa works as a crucial portal for international capitalists looking for to develop or manage an organization in the USA. This non-immigrant visa is especially designed for nationals of countries that preserve a treaty of commerce and navigation with the U.S. It makes it possible for qualified individuals to invest a significant amount of resources in a U.S.-based enterprise, consequently facilitating financial growth and job development.

The E2 Visa is especially appealing due to its flexibility relating to investment kinds. Capitalists can take part in numerous service industries, from modern technology startups to friendliness and retail endeavors. In addition, it enables for family addition, enabling the capitalist's spouse and kids to accompany them to the U.S., approving them specific rights, consisting of the capacity to participate in school and, when it comes to the partner, the possibility to apply for job permission.

In addition, the E2 Visa does not have actually a defined limitation on the number of extensions, offered the company remains operational and fulfills the visa demands. This function enables financiers to preserve a long-term existence in the U.S., promoting both personal and expert development.

Qualification Requirements

Foreign investors must satisfy specific qualification demands to get approved for the E2 Visa. The investor has to be a national of a nation that has a certifying treaty with the United States. This treaty needs to permit financial investment and the issuance of E2 Visas. The capitalist has to likewise hold at the very least 50% ownership in the venture or possess functional control via a managerial position.

Additionally, the financial investment should be significant, implying it needs to suffice to ensure the effective operation of business. The capitalist must demonstrate that the funds used for the financial investment are either their very own or legally acquired. Additionally, the service should be an actual and operating enterprise, not a limited one intended entirely at producing earnings for the investor.

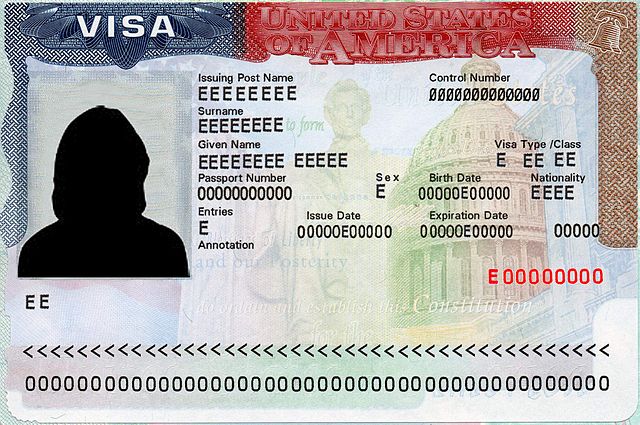

The investor has to likewise intend to establish and guide the venture, indicating a genuine dedication to the company. The investor's intention to return to their home nation after the E2 Visa expires is essential, as the E2 Visa is a non-immigrant visa (American E2 Visa). Satisfying these qualification requirements is important for a successful application for the E2 Visa

Financial Investment Amount and Kind

When pursuing an E2 visa, comprehending the minimal financial investment demands is vital for compliance and success. In addition, recognizing the different kinds of qualified financial investments can significantly impact your company strategy. This area will describe both the monetary thresholds and permissible investment avenues to lead prospective applicants.

Minimum Investment Requirements

Minimum financial investment demands for the E2 visa vary based upon the nature of business and its area. Typically, the financial investment needs to be considerable in regard to the overall cost of buying or establishing the enterprise. While no main minimum investment amount is stated by the U.S. government, a frequently accepted benchmark is around $100,000. Nevertheless, for particular companies, especially those in lower-cost industries or regions, financial investments as low as $50,000 might be considered significant.

Significantly, the funds have to be at risk, implying they should be irrevocably devoted to business and can not be taken out. Capitalists ought to additionally be prepared to supply comprehensive financial documentation to show the legitimacy and source of the funds, which is vital for the E2 visa process.

Qualified Investment Kinds

Understanding the kinds of investments eligible for the E2 visa is essential for potential financiers. This visa category allows foreign nationals to purchase an U.S. company, provided that the investment is considerable and satisfies particular requirements - E2 Visa. The investment quantity is not repaired yet should be symmetrical to the overall price of starting the service or buying. Typically, investments vary from $100,000 to $200,000, depending upon the nature of the venture

Eligible investment kinds include both abstract and concrete possessions. Tangible properties incorporate property, tools, and stock, which are vital for running the business. Abstract assets, such as licenses, licenses, or trademarks, can additionally certify if they demonstrate the company's practicality and potential.

The financial investment needs to go to threat, suggesting that the funds need to go through loss in case of organization failure. Additionally, business needs to be active and not marginal, showing that it should generate enough revenue to sustain the financier and their household. Understanding these financial investment types will much better outfit applicants in steering through the E2 visa process efficiently.

Service Plan Fundamentals

A well-structured business strategy is imperative for E2 visa candidates, as it works as a roadmap for the recommended business and a convincing device for demonstrating the practicality of the investment. Business plan must start with an exec summary that succinctly details the service concept, goals, and funding needs.

Next, a thorough market evaluation is vital, showcasing an understanding of the target market, competitors, and possible customer demographics. This section can highlight fads that might impact the company positively.

The operational plan should outline the organization framework, area, and everyday operations, including staffing and management obligations. It is essential to detail the services or items offered, stressing their distinct marketing points and competitive advantages.

Financial forecasts, including revenue statements, capital projections, and break-even analysis, are essential components that show the capacity for earnings and sustainability. The plan should identify possible dangers and overview approaches for alleviating them.

Application Refine Steps

The application process for an E2 visa involves numerous necessary steps that need to be meticulously followed to assure success. This area will certainly detail the eligibility demands, supply a thorough file prep work checklist, and offer an introduction of the interview process. Understanding these components is important for potential financiers seeking to browse the intricacies of obtaining an E2 visa.

Qualification Needs Discussed

Steering the complexities of E2 visa qualification requires cautious attention to certain financial investment requirements and application processes. To get an E2 visa, applicants must be nationals of a nation that has an appropriate treaty with the United States. This foundational demand develops the preliminary structure for eligibility.

The financial investment has to be significant, generally taken a considerable quantity of funding about the complete expense of the enterprise. While the precise figure may differ, it normally varies from $100,000 to $200,000. The financial investment ought to be at risk, implying funds ought to be dedicated and subject to loss, rather than merely held in a bank account.

Additionally, business has to be an authentic business, implying it is actual, energetic, and operating, producing income sufficient to support the investor and their family. Applicants need to additionally demonstrate their intent to develop and route the enterprise, highlighting their role in its management.

Record Preparation List

Next off, gather evidence of your financial investment funds, including financial institution statements, proof of possession possession, and any kind of monetary records that verify the resource of your funds. In addition, prepare records that show your service's lawful standing, such as unification documents, running contracts, and any required licenses or authorizations.

Individual documents are also essential; include your key, a recent photograph, and evidence of your credentials and experience in the pertinent field. It's a good idea to include your return to or curriculum vitae.

Lastly, verify that you have finished the needed forms, such as the DS-160 and DS-156E, in addition to the suitable filing fees. Organizing these files meticulously will not only improve your application process yet additionally boost the likelihood of approval.

Interview Process Summary

After collecting and arranging the needed documentation, the following action in the E2 visa process involves preparing for the interview. The interview normally happens at a united state consular office or consular office and works as a vital analysis of your application. It is important to schedule this visit well ahead of time, as delay times can differ considerably.

During the meeting, a consular police officer will certainly review your application, confirm your investment strategies, and analyze your certifications. Anticipate to discuss your organization design, financial estimates, and the source of your mutual fund. Being prepared to respond to concerns plainly and with confidence is critical, as this can significantly affect the end result of your application.

Before the interview, practice your actions and anticipate possible concerns. Bring all initial files and copies, including your organization strategy, tax obligation returns, and proof of investment. Gown skillfully to share severity regarding your application.

Adhering to the meeting, the consular policeman might authorize the visa, demand added documents, or issue a rejection. Recognizing this process allows you to navigate the E2 visa better and raises your opportunities of an effective result.

Typical Challenges and Solutions

Navigating the E2 visa process offers several common challenges that prospective investors must deal with to improve their chances of success. One considerable difficulty is showing that the investment is substantial and in danger. Financiers must offer detailed financial documentation to illustrate the feasibility of their business version and guarantee that their investment exceeds the minimum needed limit.

Another challenge depends on the demand to develop a genuine and running enterprise. Capitalists typically fight with specifying and offering a complete organization plan that describes functional methods, market analysis, and potential success. A well-structured strategy is essential to showcase the organization's legitimacy and its potential financial effect.

Furthermore, traversing the intricacies of united state immigration regulations can be daunting. Capitalists might face problems in comprehending the documentation required for the application process. Engaging a skilled immigration lawyer can relieve this problem, ensuring that all documentation is carefully ready and sent.

Lastly, social differences and language obstacles can hamper reliable communication with U.S. authorities. Financiers ought to think about looking for aid from neighborhood professionals that know with the nuances of the American organization atmosphere to facilitate smoother interactions.

Tips for Effective Authorization

To accomplish successful approval for an E2 visa, careful preparation is essential. Begin by extensively recognizing the qualification demands, including the requirement of a considerable investment in a united state business (American E2 Visa). It's vital to demonstrate that your investment suffices to ensure business's feasibility and development

Put together substantial paperwork that describes your company strategy, consisting of market analysis, monetary projections, and operational techniques. This strategy needs to clearly express how business will produce tasks for U.S. employees, as work development is a vital variable in the approval process.

Involving a qualified immigration lawyer can considerably enhance your application (USA Visa E2). They can give important guidance on steering via the intricacies of the E2 visa process and validate that all documentation is thoroughly finished and sent in a timely fashion

Additionally, plan for the consular meeting by exercising response to possible inquiries regarding your financial investment, organization strategies, and ties to your home country. Showing a clear intention to return home after your visa ends can additionally reinforce your instance. By sticking to these pointers, you enhance your opportunities of acquiring an effective E2 visa approval, opening doors to new chances in the United States.

Frequently Asked Questions

Can My Family Accompany Me on the E2 Visa?

Yes, your family can accompany you on an E2 visa. Partners and single children under 21 are qualified for derivative E2 visas, enabling them to live and study additional info in the USA during your investment duration.

The length of time Does the E2 Visa Last?

The E2 visa commonly lasts for 2 years, with the possibility of uncertain revivals, offered the investment venture continues to be operational and satisfies the visa demands. Extensions are granted based upon ongoing eligibility and business task.

Can I Switch Over Services While on an E2 Visa?

Yes, you can change services while on an E2 visa, offered the new organization fulfills all investment and functional needs. It's advisable to speak with an immigration lawyer to ensure compliance with visa guidelines throughout the transition.

Is There a Maximum Number of E2 Visa Renewals?

There is no official limitation on the variety of E2 visa renewals; nonetheless, each renewal must show ongoing organization feasibility and conformity with visa demands. USA Visa E2. Constant adherence to guidelines is crucial for successful revivals

What Happens if My Service Falls short While on an E2 Visa?

If your service falls short while on an E2 visa, you might take the chance of losing your visa status. It is important to check out alternate choices, such as moving to another visa or looking for legal recommendations for proper guidance.

Furthermore, the E2 Visa does not have actually a defined limit on the number of extensions, provided the company remains operational and satisfies the visa needs. The financier's purpose to return to their home country after the E2 Visa ends is vital, as the E2 Visa is a non-immigrant visa. The E2 visa normally lasts for two years, with the opportunity of indefinite renewals, supplied the financial investment enterprise stays functional and meets the visa needs. There is no main limit on the number of E2 visa revivals; nevertheless, each revival must show ongoing business stability and conformity with visa needs. If your service stops working while on an E2 visa, you might risk shedding your visa standing.